Ask a question about your financial situation providing as much detail as possible. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists is a leading financial education which of the following is the formula to compute the direct labor rate variance organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Great! The Financial Professional Will Get Back To You Soon.

Recall from Figure 10.1 that the standard rate for Jerry’s is$13 per direct labor hour and the standard direct labor hours is0.10 per unit. Figure 10.6 shows how to calculate the labor rateand efficiency variances given the actual results and standardsinformation. Review this figure carefully before moving on to thenext section where these calculations are explained in detail.

3 Compute and Evaluate Labor Variances

In order to keep the overall direct labor cost inline with standards while maintaining the output quality, it is much important to assign right tasks to right workers. Like direct labor rate variance, this variance may be favorable or unfavorable. If workers manufacture a certain number of units in an amount of time that is less than the amount of time allowed by standards for that number of units, the variance is known as favorable direct labor efficiency variance.

Causes of direct labor efficiency variance

If the outcome is unfavorable, the actual costs related to labor were more than the expected (standard) costs. If the outcome is favorable, the actual costs related to labor are less than the expected (standard) costs. Note that both approaches—the direct labor efficiency variancecalculation and the alternative calculation—yield the sameresult. Direct Labor Rate Variance is the measure of difference between the actual cost of direct labor and the standard cost of direct labor utilized during a period.

How do you calculate labor yield variances?

In this question, the Bright Company has experienced a favorable labor rate variance of $45 because it has paid a lower hourly rate ($5.40) than the standard hourly rate ($5.50). Note that both approaches—direct labor rate variance calculationand the alternative calculation—yield the same result. Labor yield variance arises when there is a variation in actual output from standard. Since this measures the performance of workers, it may be caused by worker deficiencies or by poor production methods. Labor mix variance is the difference between the actual mix of labor and standard mix, caused by hiring or training costs. We have demonstrated how important it is for managers to beaware not only of the cost of labor, but also of the differencesbetween budgeted labor costs and actual labor costs.

Create a Free Account and Ask Any Financial Question

He represents clients before the IRS and state taxing authorities concerning audits, tax controversies, and offers in compromise. He has served in various leadership roles in the American Bar Association and as Great Lakes Area liaison with the IRS. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- If customer orders for a product are not enough to keep the workers busy, the production managers will have to either build up excessive inventories or accept an unfavorable labor efficiency variance.

- According to the total direct labor variance, direct labor costs were $1,200 lower than expected, a favorable variance.

- Since the actual labor rate is lower than the standard rate, the variance is positive and thus favorable.

- This result means the company incurs an additional $3,600 in expense by paying its employees an average of $13 per hour rather than $12.

- Next, we calculate andanalyze variable manufacturing overhead cost variances.

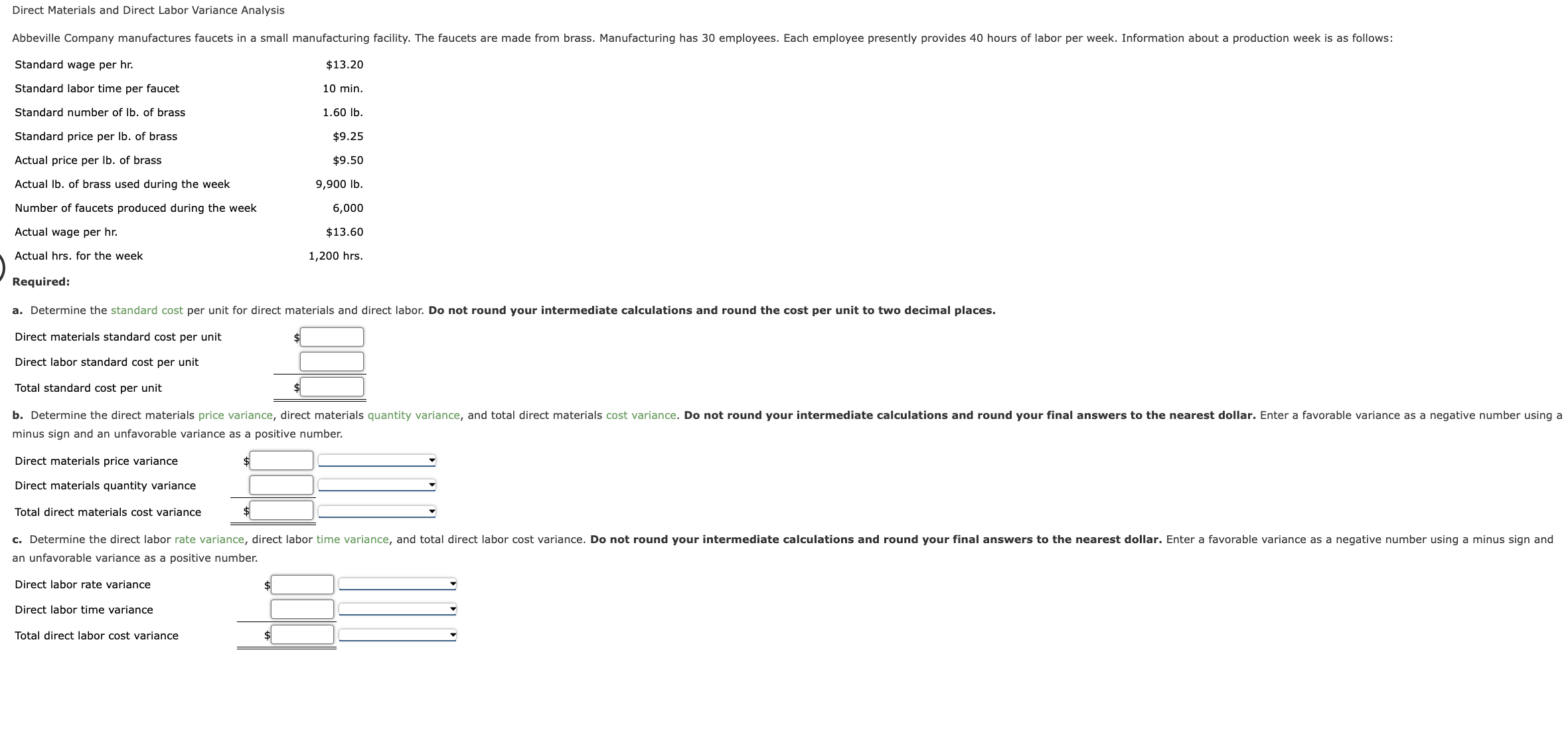

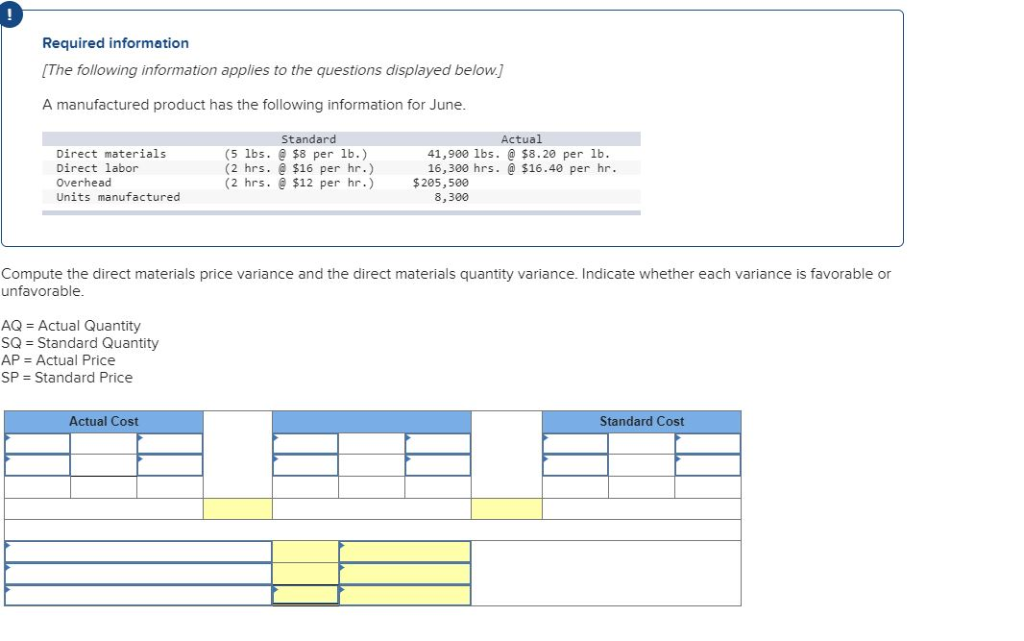

The standard direct labor rate was set at $5.60 per hour but the direct labor workers were actually paid at a rate of $5.40 per hour. Find the direct labor rate variance of Bright Company for the month of June. Figure 8.4 shows the connection between the direct labor rate variance and direct labor time variance to total direct labor variance. The direct labor variance measures how efficiently the company uses labor as well as how effective it is at pricing labor. There are two components to a labor variance, the direct labor rate variance and the direct labor time variance.

To compute the direct labor quantity variance, subtract the standard cost of direct labor ($48,000) from the actual hours of direct labor at standard rate ($43,200). This math results in a favorable variance of $4,800, indicating that the company saves $4,800 in expenses because its employees work 400 fewer hours than expected. All tasks do not require equally skilled workers; some tasks are more complicated and require more experienced workers than others.

If the actual rate of pay per hour is less than the standard rate of pay per hour, the variance will be a favorable variance. If, however, the actual rate of pay per hour is greater than the standard rate of pay per hour, the variance will be unfavorable. With either of these formulas, the actual rate per hour refers to the actual rate of pay for workers to create one unit of product. The standard rate per hour is the expected rate of pay for workers to create one unit of product. The actual hours worked are the actual number of hours worked to create one unit of product. If there is no difference between the standard rate and the actual rate, the outcome will be zero, and no variance exists.

He is a four-time Dummies book author, a blogger, and a video host on accounting and finance topics. As mentioned earlier, the cause of one variance might influenceanother variance. For example, many of the explanations shown inFigure 10.7 might also apply to the favorable materials quantityvariance. An overview of these two types of labor efficiency variance is given below. Daniel S. Welytok, JD, LLM, is a partner in the business practice group of Whyte Hirschboeck Dudek S.C., where he concentrates in the areas of taxation and business law. Dan advises clients on strategic planning, federal and state tax issues, transactional matters, and employee benefits.